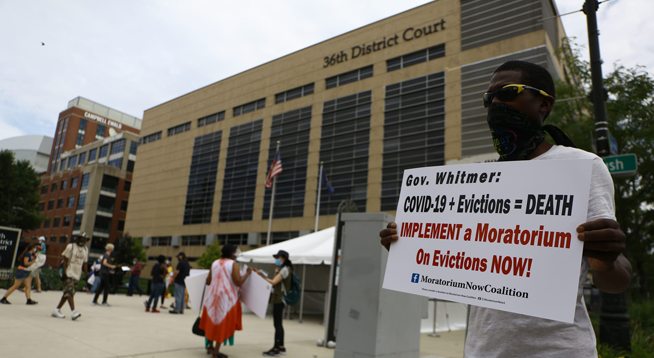

Photo: Rodney Coleman-Robinson via Imagn

Photo: Rodney Coleman-Robinson via Imagn

Editorial by Guy Gordon

760 WJR

DETROIT, October 11, 2022 ~ Is our “COVID Compassion” creating a culture of deadbeats?

As the Biden Administration prepares to grant forgiveness to student loan borrowers, I’ve asked that question of my listeners. Some have admonished my skepticism, insisting most borrowers were fulfilling their obligations and one act of generosity will not un-do a lifetime of behaving responsibly.

In rebuttal, allow me to offer an object lesson from our state’s beleaguered landlords.

My friend manages 10,000 units of rental housing in various communities throughout SE Michigan. We’ll call him Bob. He fears his criticisms of process and courts will ignite retribution.

At the outset of the pandemic, he acknowledged the emergency and the hardships it brought to his tenants. Believing it would be short-lived, he embraced the eviction moratorium as a necessity and even gave in-person instruction to struggling tenants, helping them fill out applications for Uncle Sam’s COVID Emergency Rent Assistance (CERA) program.

In August 2021 the eviction moratorium ended, but the epidemic of rent delinquencies it spawned did not. It seems an astonishing share of Bob’s renters interpreted a temporary pause on penalties, and the promise of CERA assistance, to be a permanent postponement of obligation and responsibility. His rent delinquency rate prior to the pandemic was in the single digits. Today, 20-30% of his units are in arrears — a near tripling in delinquency.

Some deadbeat renters believe the eviction moratorium is still in effect. When asked why they won’t fulfill their rental agreement, they’ll cite assurances from politicians, sometimes even mentioning the President by name, and claim “They tell me I don’t have to pay.”

Adding insult to injury, district court backlogs, zoom hearings, and an added layer of bureaucracy is now extending the COVID eviction “grace” period, and denying rental property owners the only avenue they have to enforce payment of the debt.

Landlords may now wait up to 3 months to get their first hearing in court. There is a new mandate requiring an automatic SECOND hearing. If a delinquent tenant declares they’re seeking rental assistance, they get another continuance.

Bob says, “To get funding, they weren’t asked if they were employed, just whether they were affected by COVID. It’s created a pattern, where they don’t pay their rent, but continually apply for funding. Meanwhile there is confusion and delays in the CERA funding approvals which extends the non-payment period by several more months past the second hearing. Many were denied, but we weren’t informed and that really set us back even further.”

If tenants are no-shows at hearings, many judges will give them yet another continuance.

Bob has seen some cases drag on 14 months or longer.

While legal fees mount, and rents go unpaid, landlords must still pay the cost of utilities and taxes.

Bob and other owners say this 2 and a half year exercise in “COVID Compassion” is now impacting the health, safety, and overall quality of properties. “Owners who don’t have deep pockets can’t afford to paint, repair, re-roof, or otherwise maintain properties, let alone enhance them. Many rental communities didn’t open their pools this summer because the money just wasn’t there.”

Long-term, communities at large will suffer because the quality of its rental stock will decline.

And for those that can’t muster sympathy for property owners — consider this. At one project Bob has a wait list of 40 families who desperately want to call his apartments home, but their units are currently occupied by 200 delinquent renters who refuse to pay and the judicial system refuses to evict.

Bottom line: These misguided, never-ending COVID policies are now harming the very constituency they were seeking to help. A growing minority of deadbeats will damn the responsible majority to live in tired, increasingly scarce rental units. It’s what happens when common-sense is the first and only eviction in the policy-making process.

WJR TOP STORIES: